Brookside Flavors & Ingredients LLC (BFI), a privately held company backed by Brookside Equity Partners, has been making strategic moves that position it as an emerging player in the specialty ingredients, flavor solutions , and flavor manufacturing space. While not publicly traded, BFI’s actions offer insight into broader trends within the food ingredients industry and could be of interest to investors tracking potential acquisition targets or consolidation opportunities.

Leadership Reinvention to Drive Innovation

In June 2024, BFI announced a pivotal leadership transition, appointing Sarah Staley as Chief Executive Officer. Staley brings a rich background in industrial biochemistry and executive leadership from companies such as FrieslandCampina Global and Kerry Group. Her expertise in clean-label formulations aligns with a market increasingly driven by consumer demand for transparency and natural ingredients.

Former CEO Rudy Dieperink, who led the company since 2020, has transitioned to an Operating Adviser role at Brookside Equity Partners, focusing on mergers and acquisitions. This suggests a continued emphasis on strategic expansion, likely through inorganic growth.

Strategic Acquisitions Accelerating Market Reach

BFI has actively pursued acquisitions to diversify its product offerings and strengthen its market position. Key transactions include:

- Sterling Food Flavorings (January 2024): Enhanced capabilities in custom flavor development and flavoring systems.

- Flavor Advantage (August 2022): Expanded reach into natural and organic flavor solutions.

These acquisitions signal Brookside’s intent to consolidate niche expertise across the flavor and ingredient spectrum—an increasingly attractive space due to the rise of plant-based, functional, and clean-label product trends.

Infrastructure Investment and Operational Scaling

In 2023, BFI completed a substantial renovation of its 84,000-square-foot headquarters in Addison, Illinois. Enhancements included updates to warehousing, labs, and production lines, reflecting a commitment to both R&D and customer responsiveness. This physical expansion supports the company’s growing client base across multiple food and beverage sectors.

Financial Snapshot: Modest but Growing

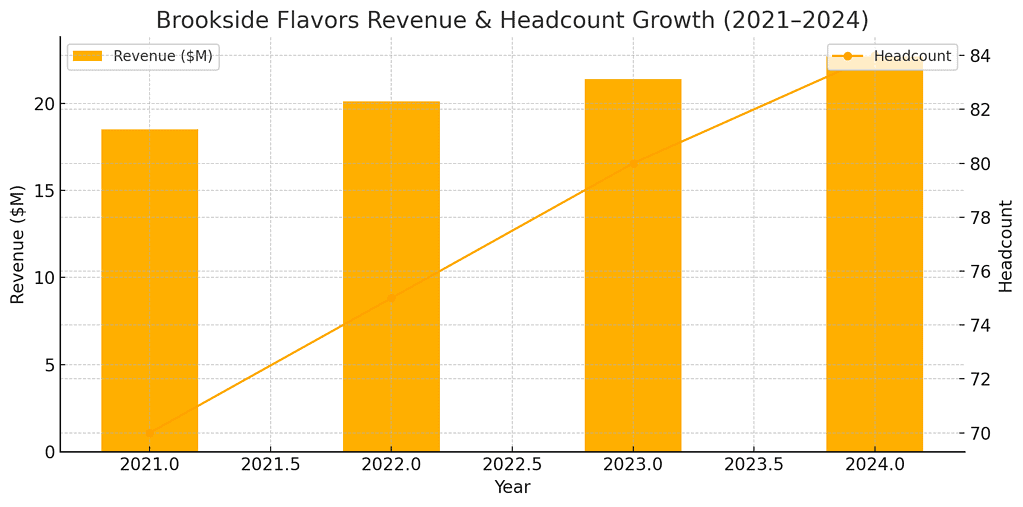

Based on publicly available estimates, BFI generates approximately $22.7 million in annual revenue and employs around 84 staff. Year-over-year workforce growth of 6.78% suggests healthy operational scaling.

The chart below illustrates Brookside’s steady trajectory in both revenue and headcount over the past several years:

IRevenue & Headcount Growth Chart

Diversification Across High-Growth Food Segments

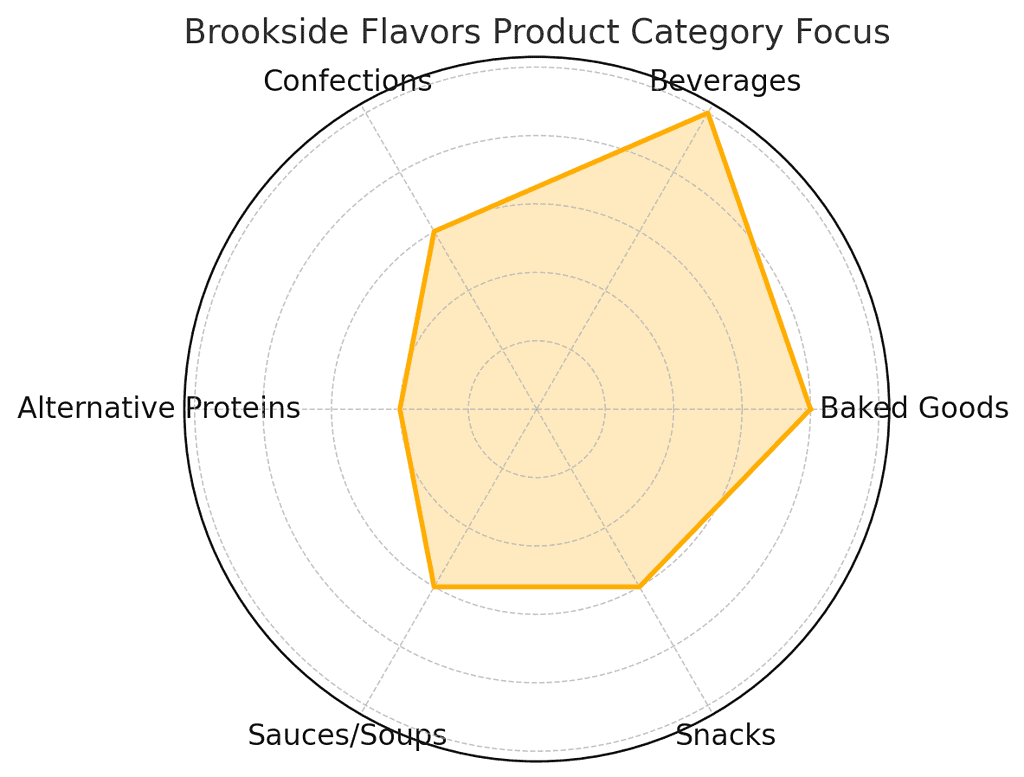

Brookside Flavors & Ingredients has strategically positioned itself across a diverse array of food and beverage categories. While not all figures are publicly disclosed, the company’s product focus—derived from industry mentions and acquisition synergies—suggests a balanced portfolio that serves both traditional and emerging consumer trends.

📊 The chart below highlights BFI’s estimated emphasis across six key sectors:

- Beverages (25%) – A core driver of innovation, particularly in functional and wellness drinks. This includes trending Non-Alcoholic, seltzers, and traditional beverages.

- Baked Goods (20%) – A traditional category where natural and organic flavoring is seeing increased demand.

- Confections (15%) – Strong historical roots with opportunities in sugar reduction and natural flavors.

- Snacks (15%) – A fast-moving sector benefiting from bold and clean-label taste innovations.

- Sauces & Soups (15%) – Especially relevant for meal kits and ready-to-eat segments.

- Alternative Proteins (10%) – A growing niche that aligns with the plant-based movement.

Product Category Focus Chart

This spread indicates that Brookside isn’t relying on a single trend but instead is building resilience through category diversification. By developing solutions for both legacy food brands and modern dietary formats, the company is well-positioned to capture value as consumer preferences evolve.

📊 Investor Insight: Diversification reduces exposure to volatility in any single market segment—making BFI more attractive as a long-term acquisition target or platform investment.

Investment Angle

While Brookside Flavors is privately held, its strategic trajectory offers signals for investors and industry watchers:

- Private Equity Playbook: The M&A strategy mirrors classic private equity value-creation moves: scale via acquisition, improve operations, and expand margins.

- Acquisition Target Potential: Given its scale, innovation focus, and clean-label positioning, BFI could be an attractive acquisition target for larger ingredient manufacturers or food conglomerates.

- Sector Insight: For investors in publicly traded peers (e.g., Kerry Group, Givaudan, IFF), BFI’s moves help map competitive dynamics and potential consolidation pathways. Sector diversity is important for any well rounded portfolio.

In summary, Brookside Flavors & Ingredients exemplifies a well-structured growth story in the specialty ingredients sector. Its proactive leadership, acquisition strategy, and market diversification mark it as a company worth watching closely in the evolving food innovation ecosystem.