In the world of finance and investment, the phrase “good investing is boring” often emerges in discussions among seasoned investors. This concept may seem counterintuitive at first glance, especially in a culture that often glorifies high-risk, high-reward scenarios. However, this saying carries profound wisdom that can guide both novice and experienced investors towards long-term financial success. In this article, we will explore what it means when someone says “good investing is boring,” the principles behind this philosophy, and why embracing this mindset can be beneficial for your investment strategy.

The Essence of “Good Investing Is Boring”

Stability Over Spectacle

When investors describe good investing as boring, they emphasize the importance of stability and consistency over the excitement of speculative, high-risk investments. This approach prioritizes:

- Long-Term Growth: Rather than seeking quick, dramatic gains, successful investors focus on gradual, steady growth over years or even decades.

- Low Volatility: Investments are chosen for their stability and resilience, which means fewer dramatic fluctuations and more predictable performance.

- Fundamentals Over Fads: Decisions are based on thorough analysis and sound financial principles rather than chasing the latest market trends or hot stocks.

Disciplined Approach

A boring investment strategy often involves a disciplined, methodical approach. This includes:

- Diversification: Spreading investments across various asset classes to mitigate risk.

- Regular Contributions: Consistently adding to investments, such as through dollar-cost averaging, regardless of market conditions.

- Re-balancing: Periodically adjusting the portfolio to maintain the desired asset allocation.

Why Good Investing Should Be Boring

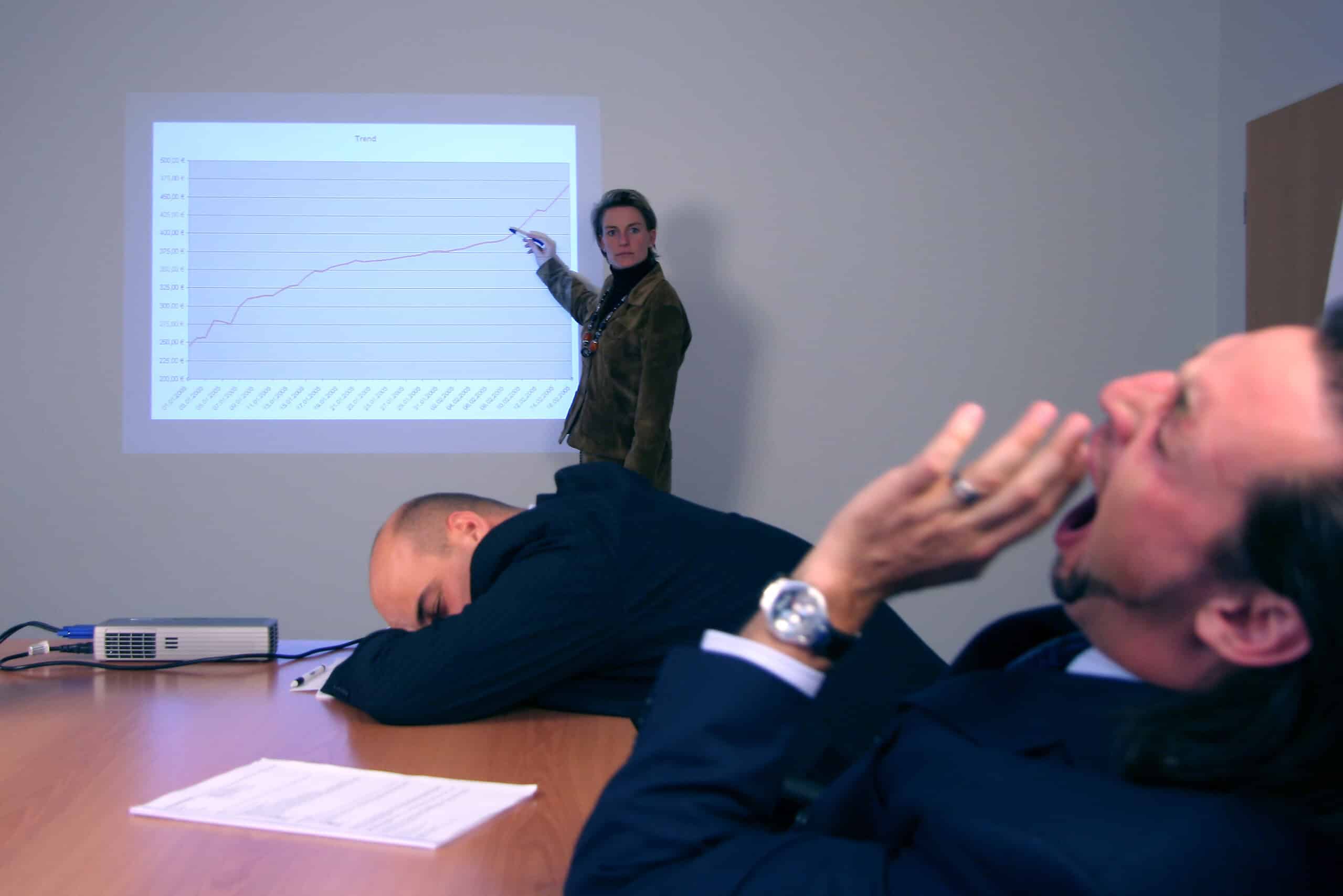

Reducing Emotional Decision-Making

One of the key benefits of a boring investment strategy is the reduction of emotional decision-making. Market volatility can trigger fear and greed, leading to impulsive actions that can be detrimental to long-term goals. By adhering to a steady, predictable investment plan, investors can avoid these pitfalls and stay the course.

Minimizing Risk

Boring investments typically involve lower risk. Blue-chip stocks, index funds, and bonds are examples of investments that, while not thrilling, offer more stable returns. This reduced risk is particularly important for those with a lower risk tolerance or those nearing retirement, who cannot afford significant losses.

Compounding Returns

The power of compounding returns is a fundamental principle of investing. By consistently investing in reliable, stable assets, investors can take advantage of compounding over time. This means that the returns generated by investments are reinvested, generating additional earnings and creating a snowball effect that can lead to substantial growth over the long term.

Examples of “Boring” Investments

Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are often cited as quintessentially boring investments. They track a specific market index, such as the S&P 500, and offer broad market exposure. Their performance mirrors the market, providing steady, long-term returns with lower fees and less active management.

Dividend-Paying Stocks

Investing in established companies that pay regular dividends is another boring yet effective strategy. These stocks provide a steady income stream and tend to be less volatile than growth stocks. Reinvesting dividends can further enhance the compounding effect.

Bonds

Bonds are typically considered one of the safest investment options. Government and high-quality corporate bonds offer predictable interest payments and return of principal at maturity. While they may not provide the high returns of stocks, they offer stability and are less susceptible to market fluctuations.

Embracing the Boring Investment Philosophy

Develop a Clear Plan

Creating a clear investment plan aligned with your financial goals is crucial. This plan should include your risk tolerance, time horizon, and asset allocation strategy. Sticking to this plan, regardless of market noise, is key to successful investing.

Educate Yourself

Understanding the principles behind boring investing can help reinforce its importance. Educate yourself on topics like diversification, risk management, and the benefits of compounding returns. This knowledge can strengthen your resolve to maintain a disciplined approach.

Patience and Persistence

Patience is a virtue in investing. Recognize that wealth-building is a marathon, not a sprint. Staying committed to your strategy, even when it feels uneventful, is essential for achieving your long-term financial objectives.

Conclusion

When someone says “good investing is boring,” they highlight the value of a stable, disciplined, and long-term approach to building wealth. By focusing on consistency, minimizing risk, and harnessing the power of compounding, investors can achieve their financial goals without the need for excitement or drama. Embracing this philosophy may not provide the thrill of speculative investing, but it offers a reliable path to financial security and success.